Unlock Your Earning Potential - Understanding the Average UK Graduate Salary and Calculating Your Take-Home Pay

Written by

Cameron BlackwoodIntroduction Starting your career journey as a graduate is exciting and overwhelming in equal measure. As you step into the professional world, naturally one of the biggest questions on your mind is your salary and what you’ll actually take home.

Understanding the average graduate salary in the UK is essential for setting realistic expectations and planning your financial future. In this post, we'll explore the averages and introduce you to an invaluable tool - StartupGradJobs' free salary calculator - to help you estimate your take-home pay after tax, national insurance, and student loan payments.

The Average UK Graduate Salary According to the Higher Education Statistics Agency (HESA), the average UK graduate salary currently falls between £24,000 and £26,000 per year. This figure is much more representative than most studies, which bias towards the highest paying graduate roles. It’s important to note though, that location is so important when assessing your salary - in London, this salary would be low but elsewhere it’s a much more competitive salary.

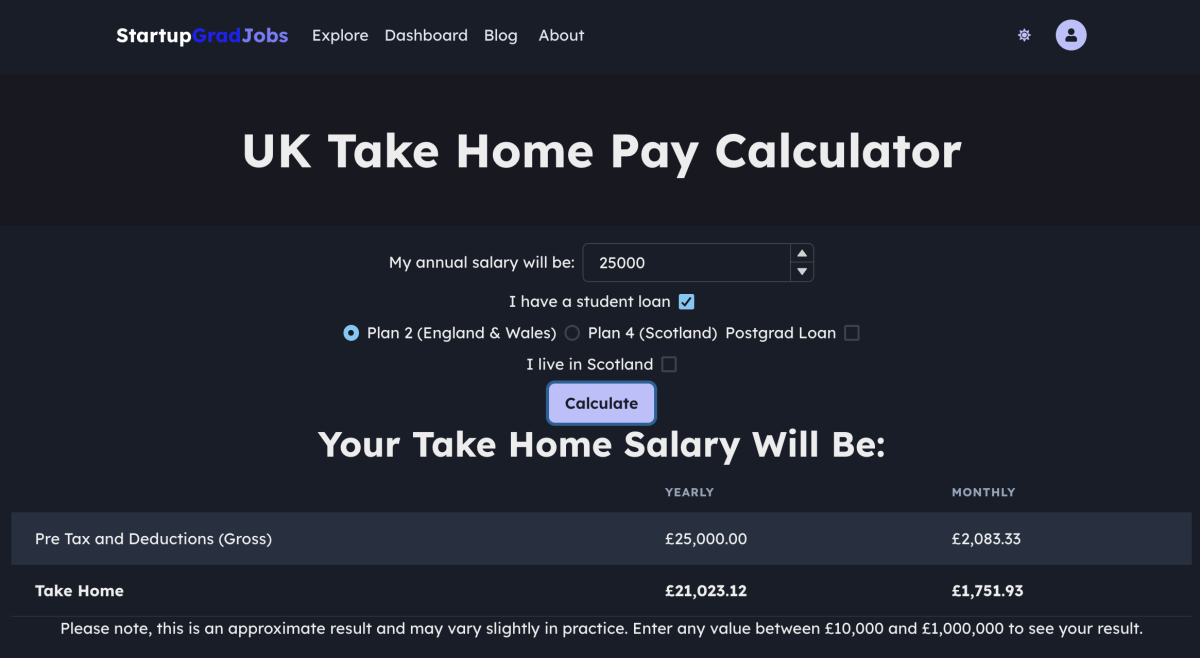

Understanding Your Take-Home Pay While the average salary provides a rough estimate of your earning potential, it's essential to consider your take-home pay after accounting for taxes, national insurance, and student loan deductions. StartupGradJobs offers a free salary calculator that empowers graduates like you to determine your net income accurately. One thing to note is that your student loan repayments will usually not start until the tax year after you graduate - which is handy when you’re starting out!

How and Why To Use The Calculator Using the calculator is easy - you just enter your pre-tax annual salary (the one advertised in a role), and input your student loan details. Usually, if you studied in Scotland you should select plan 4, and anywhere else select plan 2. Then, if you took a postgrad loan you should tick that box - it is an additional deductible, so you can work out if studying a masters would be worth the extra repayments!